Independent Contract Work: 1099 Form Contractors

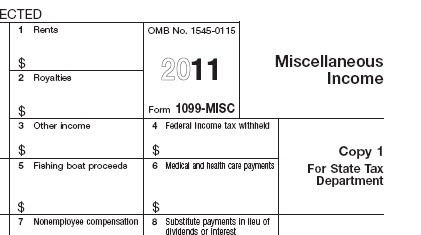

Most of here at HubPages understand that we are what's called an "independent contractor", or as we may more fondly tell people, we are "free-lancers". For the purpose of what we do here, HubPages considers us as working for ourselves, and thus we receive a 1099 form at the end of the year with the amounts that we have been paid for writing through the various HubPages programs and affiliates that are under the umbrella of HubPages (like the eBay program and the HubPages ad program)

Google also considers us as 1099 contractors, and they also send us a 1099 form at the end of the year (if you earned at least $600 from Google during the year)

Besides writers, there are also other times one may be considered a 1099 independent contractor, but certain rules apply.

State and Federal law agencies on 1099 contracting

To be considered as independent contractors, there are rules are that have been defined by law and various state agencies.

Some people are erroneously classified as 1099 independent contractors when in fact they should actually be considered as employees.

Companies that erroneously classify a person as an independent contractor are sometimes doing so to avoid paying workmen's compensation, over-time pay and unemployment claims. To find out if you are indeed a 1099 contractor, the following basic rules and guidelines apply to 1099 contractors:

Rules for being a 1099 independent contractor

- 1099 contractors set their own schedules, make their own hours and determine the days that they work. They are their own boss.

- 1099 workers should not be penalized from seeking other work or from performing other work. Independents can work for more than one company at a time.

- Contractors typically do not receive training from the company they are contracting with.

- 1099 contractors are not required to follow instructions to accomplish a job.

- Contractors can usually hire others to do the actual work (subbing out work)

- Contractors have the right to manage and control who they want to assist them in their work.

- Contractors usually work for the hiring firm at irregular intervals, on call, or whenever work is available. Most writers fall under this category.

- 1099 contractors determine where they work and are not supervised or controlled by the contracting party. They are considered freelance workers, most times.

- Contractors decide when and how they are going to perform their work.

- Contractors are hired to produce a final result and don't normally need to submit reports between jobs.

- Commission paid performance, or a set amount paid by work finished indicates a 1099 type payment agreement. If the contractor is paid by the hour this usually indicates an employer/employee relationship and the person is not considered an independent contractor.

- Contractors pay for their own business and personal expenses related to the work they are performing.

- Independent contractors usually supply their own tools and supplies (but they can be "leased" from the hiring contractor)

- As long as the contract work finished is done to specifications, the 1099 worker cannot be fired or "laid-off".

- Independent 1099 contractors can be held legally responsible for work not performed to the agreed upon terms in the contract.

- Independent contractors can make a profit - but also suffer a loss - as a result of the work performed (regular employees do not suffer a loss - only a gain from hours worked)

- A 1099 form is required to be sent at the end of each year if a business paid over $600 to an individual, sole proprietor, or partnership for services, including parts and materials (such as cleaning, repairing, remodeling, website design, writing, publishing, etc.)

Legal advice concerning 1099 forms and contracts

This list of rules and regulations regarding 1099 contracting work is not meant to be all inclusive but only to serve as a guide to helping you determine if you are truly a 1099 independent contractor. It is also not intended to be used as legal advice.

Unfortunately, some companies are taking advantage of their contracted people by making them think that this is their only option to receiving pay. This is incorrect and there are stiff fines for companies that practice this illegal maneuvering. Avoiding taxes not only hurts the economy but also the person hired if they get hurt on the job, are fired or disabled while performing work for the contracting party.

If you are unsure if you should truly be considered as a 1099 Independent contractor, read more here at the Division of Labor Standards Enforcement (DLSE)